Key Takeaways

In today’s competitive accounting landscape, effective marketing strategies are important for attracting and retaining current clients. Outsourced lead generation has become a crucial solution for many accounting firms seeking to streamline their client acquisition efforts without the overhead of maintaining an in-house team.

This comprehensive guide will cover everything about outsourced lead generation, including its benefits for accountants, how it works, and a few specific strategies tailored for accountants.

Let’s begin by understanding what outsourced Lead generation is.

Outsourced lead generation refers to the practice of hiring external agencies or specialists to manage the process of identifying, qualifying, and nurturing potential clients. This approach allows accounting companies to focus on their core services while using the expertise of professionals who specialise in lead generation.

An outsourced lead generation strategy for an accounting firm typically involves a variety of activities, including market research, targeted outreach, and the use of technology to track and manage leads. By outsourcing these tasks, firms can streamline their marketing efforts and improve their overall efficiency.

Marketing for accountants can be tough. By nature of the profession, it’s easy to stay very corporate and, in doing so, avoid creating any emotion for the buyer. People buy emotionally and back it up with logic. The other problem is that there is so much choice of what to do.

Let us understand the benefits of outsourced lead generation

One of the primary advantages of outsourcing lead generation is the cost savings it offers. For accounting firms, this means reducing expenses related to hiring a full-time employee, offering benefits and maintaining infrastructure.

Marketing for accountants can be very costly, and the expenses can add up quickly.

For example, recruiting an in-house marketing personnel may attract a pay scale of between £30,000 and £100,000 per annum, and other expenses such as employee benefits and training. Outsourcing, on the other hand, presents an opportunity to outsource only those services to which the firms can assign cash when required. It also offers the ability to switch it on and off like a tap. This flexibility is particularly good for small to medium-sized accounting firms who may not have the capital for its own marketing team, or just for those accountants who want to remain lean but be able to expand and grow more quickly.

An outsourced lead generation firm employs specialists skilled in various marketing techniques tailored specifically to the accounting industry. These specialists have experience with:

Digital Marketing for Accountants: Applying and targeting SEO, content marketing and social media approaches that will influence potential clientele.

Lead Qualification: This can also ensure that only the best and most qualified leads generated by the marketing campaign are passed on to the sales team. This process may sometimes involve evaluating leads, primarily in terms of budget, needs, and interest in engaging a specific salesperson.

Since it is essentially a matter of getting other companies to perform services, outsourcing makes it easy for firms to increase or reduce the amount of lead generation undertaken. This flexibility is important due to fluctuations in the number of new clients required at any given time, such as during tax season. For example:

In this case, an accounting firm may need more leads when businesses begin the process of filing tax returns.

On the other hand, this is extremely good news for the firm during off-peak times, when it can cut back on lead generation and other costs without losing out to the competition.

One such factor is flexibility, which gives accounting firms a perfect opportunity to accommodate market needs without having to seek new employees or train them.

How outsourcing marketing for accountants can help improve core competencies:

By outsourcing lead generation tasks, accountants can concentrate on their primary responsibilities, i.e. serving existing clients and providing high-quality financial advice, and business services, without being bogged down by marketing tasks. This focus can lead to improved client satisfaction and retention rates.

For instance, while marketing personnel spend a lot of time in grip marketing activities such as mailers, telephone calls and emails, little time is devoted in interacting with the clients or advising of new services and products, accountants can develop closer relationships with the clients and recommend complementary services that the clients need.

Let’s dig deeper into how outsourced lead generation works…..

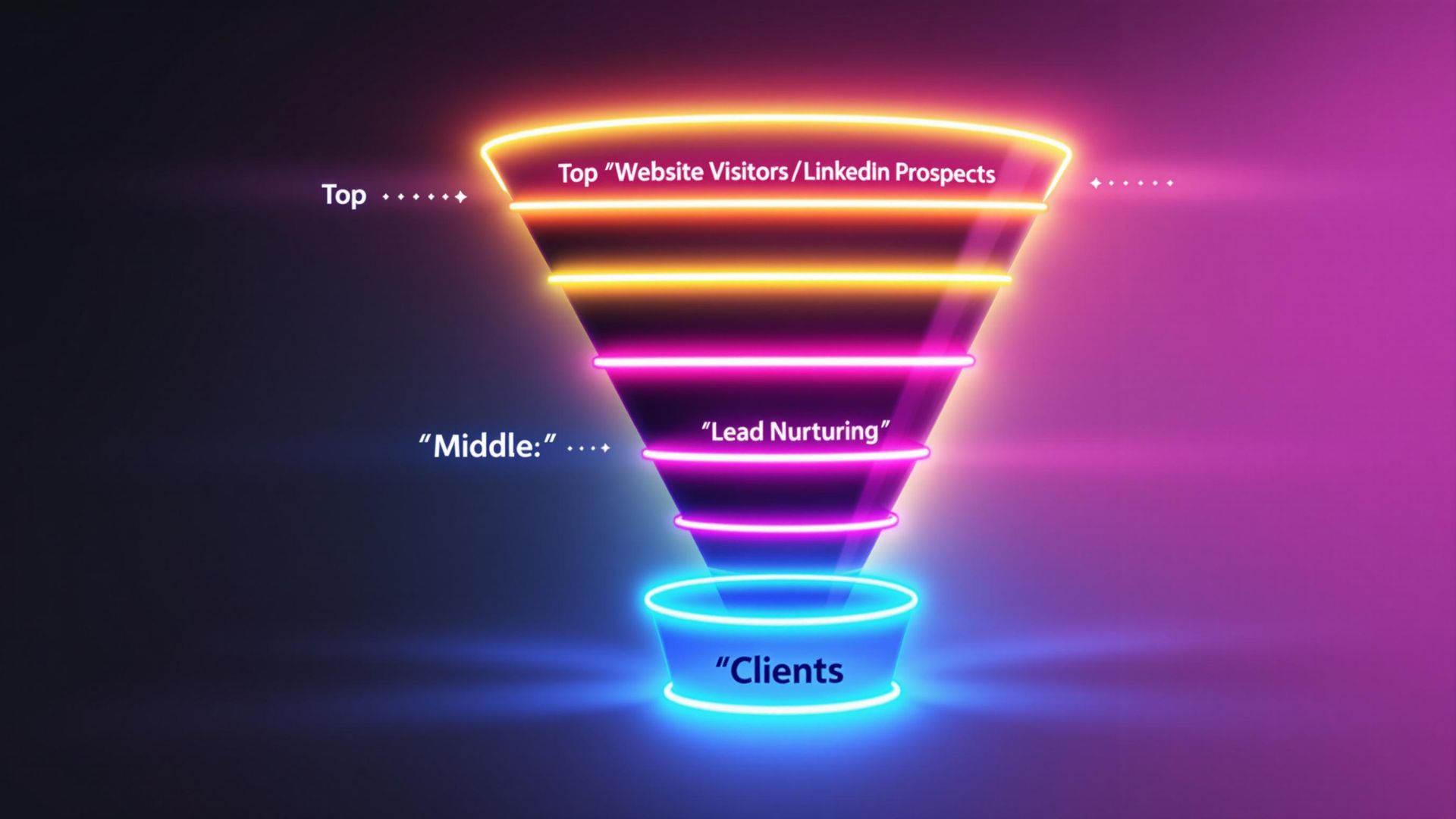

The process of outsourced lead generation typically involves several key steps:

Identifying Target Markets: Working with the outsourced agency is also useful in identifying and constructing specific and general characteristics of clients by demographics including the type of industry, size of the company, geographical location and/or specific services clients need like taxes preparation or financial consulting.

Lead Generation Strategies: The agency uses strategies to include the following:

Digital Marketing for Accountants: Applying SEO techniques to make a website rank high in search engine results pages.

Content Marketing: Is the process of developing useful content that inspires potential clients to engage with Atticus Legal Marketing and is based on typical concerns they may have.

Social Media Outreach: Connect with prospects on social media sites such as LinkedIn, as well as Facebook.

Telemarketing: This is, in some people’s opinion, dead. This is because, during the buying journey, talking to someone is often the last thing people want to do. As a result, they typically research and compare options first, and then, as a final step, they pick up the phone. That said, it is still a powerful tool when done well and in a psychologically informed, consultative manner, as opposed to the old-school fact, feature, benefit approach that throws everything at the customer.

Lead Qualification: Leads are evaluated with reference to a set of rules depending on the accounting firm’s predetermined standards. This may involve examining the prospect's budget for the purchase, the time frame for the purchase, or any prior dealings the firm has had with the prospect.

Lead Nurturing: Identifying and interacting with qualified leads in a ‘touch point’ way until the sales point can be made. It could, for example, include sending announcements or offering free items, such as initial consultations.

Reporting and Analysis: It also involves providing periodic efficiency summaries to evaluate the impact and enhance the identified approaches in the long run. Here we see the role of the conversion rates and return on investment (ROI) indicators.

Let’s look at and try to understand a few key strategies for accountants

Digital marketing is essential for accountants looking to attract new clients effectively:

SEO Optimisation: This suggests that the use of keywords such as ‘Accounting services ‘ or ‘Tax preparation ‘ can help call attention to the site from search engines. Using tools like Google Keyword Planner, it is possible to find high-traffic keywords relevant to the services offered. Backlinks can be built, and you can begin to improve the authority of your website and how well you rank for certain keywords over time

Content Marketing: Writing blogs, creating articles or an eBook, and publishing white papers helps position the business and potentially win clients. There is also the option to write newsletters on platforms such as LinkedIn.

For example, Marketing strategies can be enhanced by writing articles about common tax misconceptions businesses often make, which will showcase your firm as proficient.

Using incentives such as ‘Free guide on how to prepare your Self Assessment’ or ‘Guide on tax for property developers' as a way of getting interested visitors to surrender their email addresses is also another way to improve the mailing list.

Email Marketing Campaigns: Another benefit of using the targeted email campaigns is that it is used over a long period of time to ensure that the leads created are well nurtured. Targeting clients by the interests they have shown is useful because you have to write on topics they will find relevant.

Social media platforms offer unique opportunities for accountants:

LinkedIn lead generation: An effective market for business-to-business communications; disclosing information can improve professional status. Sharing articles or updates about industry issues can bring customers in, or at least capture their attention through a LinkedIn lead generation strategy. Let your audience no the problems you solve and how you help them, and why you.

Facebook Groups: Being part of financial advice groups can help you target and connect with potential clients who need a specialist. Opportunities for commentaries and sharing of relevant ones in such forums enable such communities to develop trust.

All other social channels, including TikTok and Instagram, offer opportunities in different ways, and Twitter, of course.

Reach out to your current clients for referrals or recommendations. This method leverages your existing relationships, making it easier to establish trust.

Create value-packed content like e-books, white papers and blog posts that establish your firm as a thought leader into the industry.

Attend local industry events or networking groups, such as BNI (Business Network International), to meet potential leads face-to-face. Building personal connections can lead to more substantial business opportunities. There is something for everyone.

Paid Advertising

Use pay-per-click advertising via platforms like Google Ads or social media ads to target specific demographics interested in accounting services.

Create incentives for current clients to refer new customers; this can boost your lead generation efforts. Moreover, offering discounts or free consultations as rewards can motivate clients to recommend the services to others.

Although often viewed negatively, telemarketing can be effective, if targeting warm leads who have shown interest in the services.

Develop partnerships with a non-competing business which serves similar clientele.

A lead generation specialist focuses on identifying and nurturing potential clients until they are ready to use your services. Their responsibilities typically includes:

Conducting market research to identify potential leads within the target audience.

Developing outreach strategies based on specific client needs.

Qualifying leads based on predetermined criteria to ensure they meet the firm’s service bracket.

Having a dedicated specialist ensures that your firm consistently attracts high-quality leads while allowing other team members to focus on service delivery.

You can invest in training to enhance your understanding of sales and marketing, or to equip your sales teams with the skills necessary to sell more effectively. The world of sales has undergone significant changes in the last decade, and with the introduction of AI and shifts in consumer buying behaviour, it is expected to evolve further in the next year or two.

These training programs should cover topics such as consultative selling techniques, objection handling and closing strategies designed specifically for the accounting industry, but also how AI can be used to help you to grow.

For accountants focusing on business clients, B2B sales training is important for:

Developing a long-term relationship rather than focusing solely on immediate sales.

Understanding the unique challenges faced by businesses in different industries helps design your service offering effectively.

B2B sales training should focus on understanding client needs through effective questioning techniques and active listening skills.

To evaluate the effectiveness of outsourced lead generation efforts, consider tracking these key performance indicators:

| KPI | Description |

| Cost per Lead (CPL) | Total campaign cost divided by the number of leads generated |

| Lead Conversion Rate | Percentage of leads that become qualified prospects |

| Return on Investment | Revenue generated from leads compared to outsourcing costs |

| Sales growth | Increases in sales volume correlated with lead generation efforts. |

| Customer Lifetime Value | Revenue expected from a customer throughout their relationship. |

By tracking these metrics, firms can understand which strategies work best and where adjustments are needed. Regularly reviewing performance data enables continuous improvement of the lead generation outsourcing process.

While outsourced lead generation offers a number of advantages, it comes with its own challenges:

Quality control: Ensuring that the quality of leads for accounting meets your standard needs requires clear communication and ongoing oversight.

Alignment with brand values: It is essential that an outsourced team understand your firm’s values and messaging so they accurately represent your brand when reaching out to your potential clients.

Integration issues: Integrating outsourced processes with existing internal systems may require additional resources or adjustments.

Dependence on external agencies: Relying heavily on an external agency means that any changes they make could directly impact your firm’s success metrics.

To mitigate these challenges:

Establish clear expectations from the outset regarding goals and performance metrics.

Maintain regular communication with your outsourcing partner through scheduled check-ins or progress reports.

Provide training sessions on your firm’s culture and values to ensure external teams accurately reflect them during outreach efforts.

Outsourced lead generation offers significant advantages for accountants looking to enhance their marketing efforts and client acquisition strategies. By leveraging specialised expertise, firms can achieve efficiency, cost savings, and improved lead quality while focusing on their core competencies.

The expected increase in competition in the accounting sector will make it very important for accounting companies to adopt outsourced solutions. Combined with outsourced services, successful digital marketing will guarantee a steady stream of excellent-quality leads and further strengthen a firm’s bond with its customers. We've worked with lots of Accountants to grow their practices. Book a Strategy Call

Is outsourcing lead generation cost-effective compared to in-house solutions?

Yes, outsourcing is cost-effective. It reduces costs associated with hiring full-time employees, offering flexibility without compromising quality, particularly for small to medium-sized businesses.

How do we ensure lead quality meets our standards?

Your lead generation person/agency should maintain clear communication and provide regular reporting, ensuring that the leads generated align with your expectations and the firm's standards.

Can outsourced lead generation keep pace with fluctuating demand?

Yes, services are scalable, allowing you to adjust lead generation activities based on your firm's current needs.

Are the strategies provided specific to the accounting industry?

It depends on the company/person you deploy, our specialists have expertise in marketing for accountants. Using tailored strategies such as LinkedIn lead generation, AI SEO & GEO, PR, content marketing, and targeted social media outreach can really benefit your business. We've worked with lots of Accountants to grow their practices. Book a Strategy Call

What measures should accounting firms employ in maintaining lead quality when outsourcing?

Lead quality can be protected by pre-defining and communicating lead qualification requirements, and regularly observing and ensuring the outsourced team is aligned with the firm’s methods.

What are the myths related to the outsourcing of lead generation?

One tendency is the belief that outsourcing results in the loss of direct control over marketing activities; however, proper outsourcing means coordinated cooperation that helps retain strategic management.